Notice of Annual General Meeting

of Shareholders and

20182020 Proxy Statement

Your vote is important

Please vote by using the Internet, the telephone,

or by signing, dating, and returning the enclosed proxy card

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |

AXIS CAPITAL HOLDINGS LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Notice of Annual General Meeting

of Shareholders and

20182020 Proxy Statement

Your vote is important

Please vote by using the Internet, the telephone,

or by signing, dating, and returning the enclosed proxy card

March 27, 2018April 2, 2020

Dear Shareholder:

You are cordially invited to attend the 20182020 Annual General Meeting of Shareholders of AXIS Capital Holdings Limited (“AXIS”), to be held at AXIS House, 92 Pitts Bay Road, Pembroke HM 08, Bermuda on Wednesday,Thursday, May 2, 20187, 2020 at 8:30 a.m. local time.

The attached Notice of Annual General Meeting of Shareholders and Proxy Statement describe the formal business to be transacted at the Annual General Meeting. During the Annual General Meeting, we will make available information relating to the operations of AXIS during the past year. Representatives from our independent registered public accounting firm, Deloitte Ltd., will be present to respond to questions from shareholders.

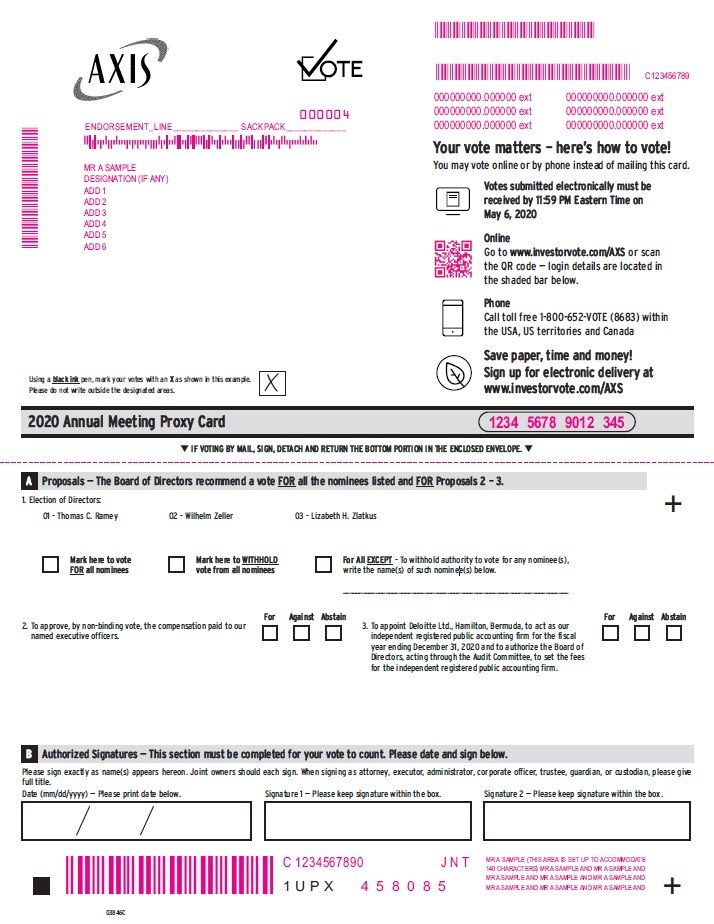

Please mark, date, sign and return your proxy card in the enclosed envelope by following the instructions on the proxy card at your earliest convenience. You may also vote over the Internet or by telephone by following the voting instructions printed on your proxy card. This will assure that your shares will be represented and voted at the meeting even if you do not attend.

Sincerely,

Michael A. Butt

Chairman of the Board

|

|

Thursday, May

| ||||

|

|

AXIS House 92 Pitts Bay Road Pembroke HM 08 Bermuda

| ||||

| ||||||

| 1. | To elect the | |||||

| 2. | To approve, bynon-binding vote, the compensation paid to our named executive officers; | |||||

| 3. | To appoint Deloitte Ltd., Hamilton, Bermuda, to act as our independent registered public accounting firm for the fiscal year ending December 31, | |||||

| 4. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. | |||||

|

|

Close of business on March | ||||

By Order of the Board of Directors,

Conrad D. Brooks

Corporate Secretary

March 27, 2018April 2, 2020

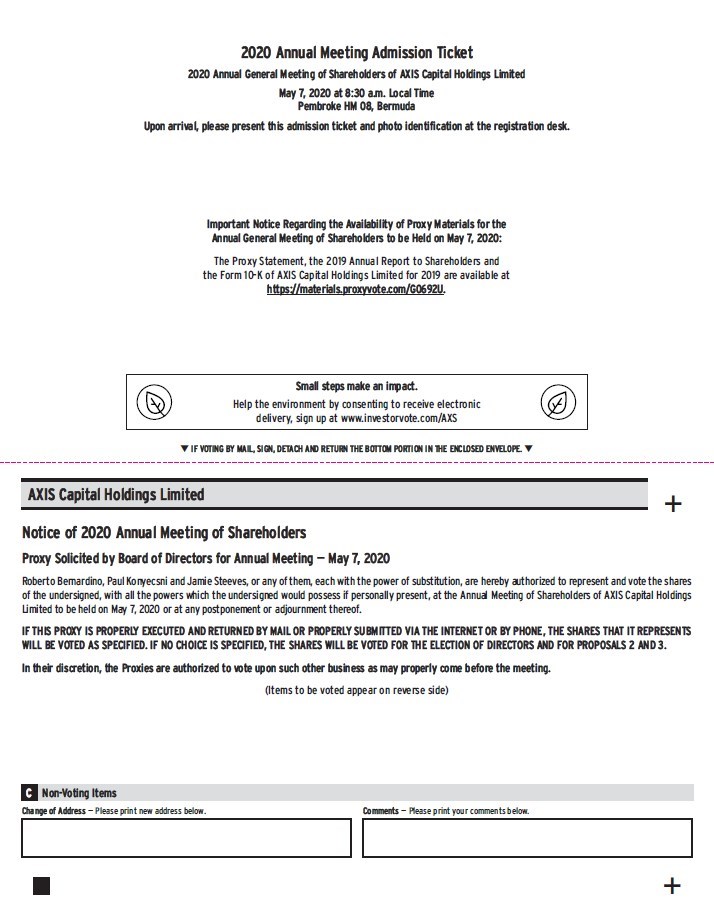

This Notice of Annual General Meeting of Shareholders and Proxy Statement are being distributed or made available, as the case may be, on or about March 27, 2018.April 2, 2020. The Proxy Statement, the 20172019 Annual Report to Shareholders and the Form10-K of AXIS Capital Holdings Limited for 20172019 are available at https://materials.proxyvote.com/G0692U.

PLEASE COMPLETE, DATE, SIGN AND RETURN THE ACCOMPANYING PROXY CARD IN THE RETURN ENVELOPE FURNISHED FOR THAT PURPOSE AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT. YOU ALSO MAY VOTE OVER THE INTERNET OR BY TELEPHONE BY FOLLOWING THE VOTING INSTRUCTIONS PRINTED ON THE ACCOMPANYING PROXY CARD.

Notice of Annual General Meeting Of Shareholders DATE AND TIME PLACE ITEM OF BUSINESS RECORD DATE

| Table of Contents |   |

| Proxy Statement Summary | 1 | |||

| Proposal 1. Election of Directors | ||||

| 6 | ||||

| 7 | ||||

| 9 | ||||

| Corporate Governance | 12 | |||

| 16 | ||||

Code of Business Conduct and Corporate Governance Guidelines | ||||

| 18 | ||||

| Principal Shareholders | ||||

| Executive Officers | ||||

| Proposal 2.Non-Binding Vote on Executive Compensation | ||||

| 25 | ||||

| Compensation Discussion and Analysis | ||||

| 27 | ||||

| 27 | ||||

| 28 | |||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| OTHER COMPENSATION TOPICS | ||||

Restriction on Trading by Directors and Officers/Anti-Hedging and Pledging | ||||

| 45 | ||||

Stock Ownership Guidelines for Directors and Executive Officers | ||||

| Compensation Committee Report | ||||

| Executive Compensation | ||||

Employment and Other Agreements with Named Executive Officers | ||||

| Equity Compensation Plan Information | ||||

| Audit Committee Report | ||||

| Proposal 3. Appointment of Independent Auditors | ||||

| Principal Accounting Fees and Services | ||||

| Shareholder Proposals for | ||||

| Other Matters | ||||

| Appendix 1 | A-1 | |||

| PROXY STATEMENT SUMMARY |

AXIS Capital Holdings Limited |

8:30 a.m. local time

AXIS House

92 Pitts Bay Road

Pembroke HM 08

Bermuda

| Directions to the |

Definition | When used in this proxy statement, the terms “we,” “us,” “our,” “the Company,” “AXIS” and “AXIS |

Agenda | 1. | The election of the |

| 2. | The approval, bynon-binding vote, of the compensation paid to our named executive officers. |

| 3. |

| 4. | Such other business as may properly come before the meeting or any postponements or adjournments thereof. |

Proxies Solicited By | The Board of Directors of AXIS Capital Holdings Limited. The Company will bear the cost of soliciting proxies for the Annual General Meeting. |

First Mailing Date | We anticipate mailing the proxy statement on |

Record Date | March |

Voting | Except as set forth in ourbye-laws, each common share entitles the holder of record to one vote. In accordance with ourbye-laws, shareholders whose shares constitute 9.5% or more of the voting power of our common shares are entitled to less than one vote for each common share held by them, but only in the event that a U.S. shareholder, as defined in ourbye-laws, owning 9.5% or more of our common shares is first determined to exist. We will notify any shareholder whose voting power is reduced prior to the meeting. |

Majority Vote Standard | Two or more persons present in person and representing in person or by proxy shares representing more than fifty percent (50%) of the aggregate shares represented by voting power of the Company constitutes a quorum. Abstentions and “brokernon-votes” that are present and entitled to vote at the Annual General Meeting will be counted for purposes of determining a quorum. A “brokernon-vote” occurs when a nominee holding shares for a beneficial owner does not have discretionary voting power for a proposal and has not received instructions from the beneficial owner. Under current New York Stock Exchange (“NYSE”) rules, the proposal to appoint Deloitte as our independent registered public accounting firm is considered a “discretionary” item. Therefore, there will be no “brokernon-votes” on the approval of the appointment of Deloitte. |

| The affirmative vote of a majority of the votes cast by the holders of shares represented in person or by proxy at the Annual General Meeting is required for: (i) the election of directors; (ii) thenon-binding determination of the compensation paid to our named executive officers; and (iii) the appointment of Deloitte. |

| PROXY STATEMENT SUMMARY 1 | |

| In determining whether: (i) a director nominee has been elected by the shareholders; (ii) the compensation paid to our named executive officers |

|

has been approved; and (iii) the appointment of Deloitte has been approved, abstentions and “brokernon-votes” (if applicable) will have no effect on the outcome of any of these proposals because such shares are not considered votes cast. |

| We will count common shares held by shareholders who have signed their proxy cards or properly submitted their proxy by phone or over the Internet but have not specified how their shares are to be voted towards the presence of a quorum, and we will vote those shares in accordance with the Board’s recommendations for each of the proposals contained in this proxy statement. |

Proxies | We will vote signed returned proxies “FOR” (i) the election of each of the |

Revoking Your Proxy | Any shareholder giving a proxy has the power to revoke it prior to its exercise by sending notice of revocation to our Corporate Secretary in writing, by executing and delivering a subsequent proxy card or by voting in person at the meeting. To revoke a proxy previously submitted over the Internet or by telephone, you may simply vote again at a later date, using the same procedures, in which case your later submitted vote will be recorded and your earlier vote revoked. You may also vote in person at the Annual General Meeting. |

| While we have every intention of holding the Annual General Meeting as indicated in the “Notice of Annual General Meeting of Shareholders”, if exigent and unexpected circumstances, such as a global health crisis, prevent the Company from holding the Annual General Meeting as planned, we may determine to change the location or format of the Annual General Meeting. If the Company needs to take such action on an exceptional basis, we plan on issuing a press release and posting an update on our website at www.axiscapital.com, notifying our shareholders of such development. Any such decision by the Company has no impact on a shareholder’s ability to provide their proxy by using the Internet or telephone or by completing, signing, dating and mailing their proxy card, each as explained in this proxy statement. |

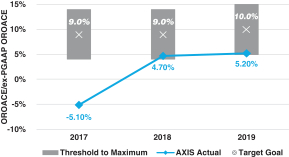

2019 Company Financial Performance |

AXIS Capital’s 2019 financial results for these performance metrics are set forth below:

| Measure | Fiscal Year 2019 | Change versus Fiscal Year 2018 | ||

Ex-PGAAP OROACE (1) | 5.2% | 0.5% pts | ||

ROACE | 6.3% | 6.3% pts | ||

Total Shareholder Return (2) | 18.3% | 12.5% pts | ||

| (1) | See Appendix 1 for a |

| (2) | One-year total shareholder return with dividends reinvested. |

|

Ex-PGAAPOROACE, is calculated by dividing |

| 2 PROXY STATEMENT SUMMARY |   | |

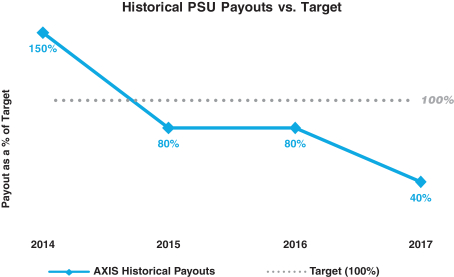

Evolution of our Compensation Program | The Committee is focused on ensuring that our executive compensation programs attract, retain and motivate leaders who create long-term value for our shareholders. Following a thorough review of our executive compensation program and incorporating feedback received from our shareholders, the Compensation Committee made the following changes to our compensation program in 2019 and 2020. |

Compensation Program Changes | Rationale | |

For Fiscal Year 2019 | ||

Changed performance metric for PSUs to relative TSR | • | The use of relative TSR as the performance metric for the PSUs is designed to align payouts with shareholder value creation. |

TSR is an objective, transparent measure that is aligned with shareholders.

Since a significant portion of our NEOs’ compensation is provided in the form of equity, TSR has a strong impact on the compensation realized by executives over time.

Revised performance scale for PSUs | • | Maintains executives’ alignment to our long-term goals. |

The prior PSU design allowed several cycles of awards to be negatively impacted in the event of a single year or quarter of catastrophic events, eliminating their retentive power.

The plan reduces the volatility of PSU payouts in line with the Company’s senior officers and directors, in orderfocus to encourage a long-term focus in managing the Company;less-volatile business.

Expanded Performance Peer Group for assessing performance of PSUs | • | Addresses the reduced number of comparable peers due to merger and acquisition activity. |

Provides a statistically-robust sample to avoid potential relative payout anomalies that could occur with a smaller sample size.

Better represents AXIS’ global footprint by adding relevant international peers.

Eliminated three-year performance look back previously used to determine the grant pool | • | Ensures that executives’ interests are aligned with the interests of our shareholders through the ownership of stock. |

The removal of the look back simplifies the program and limit perquisites;is consistent with market practice.

The removal of the look back eliminates the possibility that new NEOs under certain circumstances;are awarded stock based on retrospective performance goals.

For Fiscal Year 2020 | ||

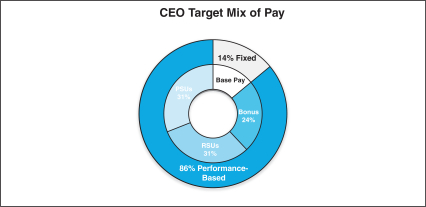

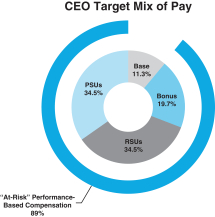

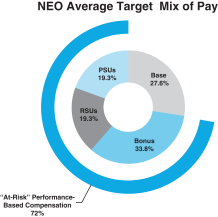

Adjusted the annual incentive mix for our CEO to increase the weighting of financial metrics and decrease the weighting ofnon-financial metrics | • | Places a stronger emphasis on financial results for the CEO and increases the portion on the bonus that is subject to formulaic assessment of financial results. |

Adjusted the long-term incentive mix for our CEO to increase the weighting of PSUs and decrease the weighting of RSUs | • | Increases the portion of the CEO’s equity award that is tied to relative TSR performance and provides for a stronger alignment with shareholders. |

Added a TSR governor, whereby an award cannot exceed target if absolute TSR is negative | • | Aligns with corporate governance best practice and ensures that executives’ PSU payouts are aligned with shareholder value creation. |

Increased required stock ownership levels for CEO | • | Ensures even greater alignment between our CEO and shareholders. |

Increased the target performance goal for the PSUs from the 50th percentile to 55th | • | Increases the rigor of the goals and ensures target payouts are only received if relative TSR performance exceeds the majority of peers. |

| PROXY STATEMENT SUMMARY 3 | |

Corporate Governance Highlights | Corporate |

Lead Independent Director role

Majority vote standard for election of directors

Regular shareholder engagement

Regular Board and committee self-evaluations

Majority independent Board and fully independent Audit, Compensation and Corporate Governance and Nominating Committees

None of our directors serve on the board of directors of more than three other publicly-held corporations

Majority vote standard for election of directors

No stockholder rights plan (“poison pill”)

Shareholders holding 10% or more of our outstanding stock have the right to call a special meeting

Shareholder Engagement and Responsiveness to Shareholders | • | During 2019, we reached out to shareholders representing over 61% of our outstanding shares and ultimately held meetings with holders of approximately 45% of our outstanding shares. |

Our Lead Independent Director and Chairman of the Compensation Committee, Henry Smith, actively participated in a majority of these meetings.

During these meetings, we discussed our executive compensation and governance practices as well as environmental, social and sustainability topics.

Responding to shareholder feedback, changes were made to our compensation program as summarized in “Evolution of our Compensation Program” above and fully independent Audit, Compensationdiscussed in further detail in “Compensation Discussion and Corporate GovernanceAnalysis—Executive Summary, Shareholder Engagement and Nominating CommitteesResponsiveness to 2019 Say on Pay Vote”.

Prompt return of your proxy will help reduce the costs of resolicitation.re-solicitation.

| ||

| 4 PROXY STATEMENT SUMMARY |  | |

| PROPOSAL 1. ELECTION OF DIRECTORS |

Our Board is divided into three classes, designated Class I, Class II and Class III. The term of office for each Class III director expires at this year’s Annual General Meeting to be held on May 2, 2018;7, 2020; the term of office for each Class III director will expire at the Company’s Annual General Meeting in 2020;2021; and the term of office for each Class III director will expire at the Company’s Annual General Meeting in 2019.2022. At each annual general meeting of the Company, the successors of the class of directors whose term expires at that meeting will be elected to hold office for a term expiring at the annual general meeting to be held in the third year following the year of their election.

TwoThree Class III directors are to be elected at the meeting to hold office until the Company’s Annual General Meeting in 2021.2023. All of the nominees are currently are directors. Our Corporate Governance and Nominating Committee recommended all of the nominees to our Board for election at the meeting. All nominees have consented to serve if elected. We do not expect that any of the nominees will become unavailable for election as a director, but if any nominee should become unavailable prior to the meeting, proxy cards authorizing the proxies to vote for the nominees will instead be voted for substitute nominees recommended by our Board.

Our Board has reviewed its classified board structure and continues to believe that this structure provides greater stability and continuity in the Board’s membership and in the direction and guidance that it provides to the Company’s management.

As compared with an annual election process, this approach promotes a long-term perspective to our strategic objectives and has proved beneficial to our CEO and executive management in establishing the Company’s shortshort- and long-term priorities. We believe that a classified election process remains in the best interests of our shareholders.

SKILLS, QUALIFICATIONS AND EXPERIENCE OF DIRECTORS

In order for the Board to satisfy its oversight responsibilities effectively, the Board seeks members who combine the highest standards of integrity with significant accomplishment in their chosen field of endeavor. The Corporate Governance and Nominating Committee is responsible for recommending qualified candidates for directorships to be filled by the Board or by our shareholders. Directors are expected to bring a diversity of experiences, skills and perspectives to our Board. The Committee considers qualities of intelligence, honesty, perceptiveness, good judgment, high ethics and standards, integrity and fairness to be of paramount importance. It also examines experience, knowledge and skills in business judgment, leadership, strategic planning, general management practices and crisis response. In addition, the Committee looks for candidates with financial expertise and a willingness and ability to commit the time required to fully discharge their responsibilities to the Board. The Committee evaluates candidates on the basis of their qualifications and not on the basis of the manner in which they were submitted for consideration.

In addition, although the Board doesAlthough we do not have a formal policy with regard to the consideration of diversity in identifying director nominees, among the many factors that the Committee carefully considers are the benefits to the Company ofviews diversity ofas an essential element for our Board’s composition and effectiveness. Attributes such as race, gender, age, ethnicity and national origin are considered in board composition.the identification and evaluation of our director candidates that will be additive to our overall Board’s diversity.

When considering whetherThe below table illustrates the Board’s directorscontinued commitment to selecting highly qualified and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Board focused primarily on the information discussed in each of the Board members’ or nominees’ biographical information set forth in “Director Nominees” and “Directors Continuing in Office” below. In particular, the Board considered the following:

|

In addition, in connection with the nominations of Messrs. Butt and Davis for election as directors at the 2018 Annual General Meeting, the Board considered their valuable contributions to the Company’s success during their term of Board service.varied yet complementary functional backgrounds.

| ||

| PROPOSAL 1. ELECTION OF DIRECTORS 5 | |

HIGHLY QUALIFIED BOARD PROVIDES EFFECTIVE OVERSIGHT

| ||||||||||||||||||||||||||||||||||||||||||||

| DIRECTORS |

|  |  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||||||

EXPERIENTIAL CRITERIA (1) | ||||||||||||||||||||||||||||||||||||||||||||

Public Company Experience |

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

| |||||||||||

Digital Experience |

| ✓ |

|

| ✓ |

| ||||||||||||||||||||||||||||||||||||||

Insurance Experience |

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

| |||||||||||||||||

Reinsurance Experience |

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

| |||||||||||||||||||||||||||||

Finance Experience |

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

| |||||||||||

International Experience |

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

| |||||||||||||||||

Banking Experience |

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

|

| ✓ |

| |||||||||||||||||||||||

Legal/Regulatory Experience |

| ✓ |

| |||||||||||||||||||||||||||||||||||||||||

COMPOSITION | ||||||||||||||||||||||||||||||||||||||||||||

Other Current Public Boards |

| 0 |

|

| 0 |

|

| 2 |

|

| 0 |

|

| 0 |

|

| 0 |

|

| 0 |

|

| 0 |

|

| 2 |

|

| 1 |

|

| 1 |

| |||||||||||

Age |

| 62 |

|

| 77 |

|

| 71 |

|

| 61 |

|

| 75 |

|

| 47 |

|

| 76 |

|

| 71 |

|

| 60 |

|

| 75 |

|

| 61 |

| |||||||||||

Tenure (Years) |

| 8 |

|

| 17 |

|

| 17 |

|

| 0.4 |

|

| 13 |

|

| 1.3 |

|

| 10 |

|

| 15 |

|

| 1.6 |

|

| 10 |

|

| 1 |

| |||||||||||

Gender |

| M |

|

| M |

|

| M |

|

| F |

|

| M |

|

| F |

|

| M |

|

| M |

|

| F |

|

| M |

|

| F |

| |||||||||||

| (1) | Competencies with a “✓” indicate substantial professional experience. |

Our Board is committed to orderly director succession planning and having a diversity of skills and experiences on our Board aligned with our long-term strategy. Our Board benefits immensely from the industry expertise of our longer-tenured directors, yet also recognizing the importance of regular, thoughtful refreshment, our Corporate Governance and Nominating Committee has embarked on a thoughtful director succession planning process. With the assistance of a third-party search firm, our Corporate Governance and Nominating Committee identified the skills and experience which the Company would need to lead the Company into the future, in line with our evolving strategy, and has evaluated director candidates based upon these desired qualities, attributes and skills. This succession planning has been conducted over time, as part of a multi-stage process, to ensure that the Company continues to benefit from the Company-specific expertise of our longer-tenured directors, balanced with the fresh perspectives brought by our newer directors.

Our director succession planning and refreshment process:

Emphasized the importance of diversity, resulting in the appointment of four highly qualified women to our Board since 2018

Focused on expanding the collective skills and experience of our Board with our new directors bringing deep financial and industry expertise, regulatory experience, innovative thinking and strategic perspective

| 6 PROPOSAL 1. ELECTION OF DIRECTORS |  | |

Highlights of our directors continuing in office include the following:

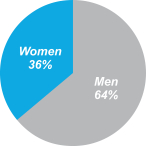

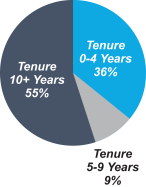

Gender | Tenure | Independence | ||

|  |  |

The table below sets forth the names, ages, classes and positions of the nominees who are standing for election at the meeting.

| Name | Age | Class | Position | Since | ||||

| | 76 | II | Independent Director | July 2009 | ||||

| Wilhelm Zeller | 75 | |||||||

| Independent Director | July 2009 | |||||||

| Lizabeth H. Zlatkus (1) | 61 | II | Independent Director | March 2019 | ||||

| (1) | Ms. Zlatkus was first identified as a director candidate by our third-party search firm as part of our Board refreshment process. Upon the recommendation by the Committee, Ms. Zlatkus was unanimously appointed by the Board effective March 15, 2019. |

|

Former Chairman and President of Liberty International, a wholly owned subsidiary of Liberty Mutual Group, from 1997 to 2009. Also served as Executive Vice President of Liberty Mutual Group from 1995 through 2009.

Served as President and Chief Executive Officer of American International Healthcare, a subsidiary of AIG.

Founder and President of an international healthcare trading company.

Currently a trustee of the Brookings Institution.

Former director of The Warranty Group, the International Insurance Society, the Coalition of Services Industries and Chairman of the International Fund for Animal Welfare.

Former member of the Chongqing, China Mayor’s International Advisory Council.

| Key Qualifications: The Board |

|

Served as the Chairman of the Executive Board of Hannover Re from 1996 to June 2009.

Served as a member of the Executive Board of Cologne Re from 1977 through 1995 and served as a member of the Executive Council of General Re Corporation, the new principal shareholder of Cologne Re, in 1995.

| PROPOSAL 1. ELECTION OF DIRECTORS 7 | |

Served as the head of the Casualty Department and International DepartmentNon-Life at Zurich Insurance Company from 1970 through 1977.

An NACD board leadership fellow, he currently is a corporate director and consultant, serving as a director of EIS Group Ltd. and Willis Towers Watson.

| Key Qualifications: The Board believes Mr. Zeller is qualified to serve as a director |

Lizabeth H. Zlatkus | Experience: |

Served in various senior leadership positions during her tenure with The Hartford Financial Services Group from 1983 to 2011, including Chief Financial Officer and Chief Risk Officer of the firm andCo-President of Hartford Life Insurance Companies; and as Executive Vice President of The Hartford’s international operations and the group life and disability divisions.

Serves as a director on the boards of Boston Private Financial Holdings, Inc.;SE-2, a privately held technology services company; and the Pennsylvania State University Business School Board, where she also served as Chair from 2012 to 2015.

She is also Vice Chair of the Connecticut Science Center Trustee Board, serving on its executive committee since 2012.

Formerly, a director of Legal & General Group plc; Computer Sciences Corporation; and Indivior plc.

Previously served as Regulatory Chair for the North American Chief Risk Officers Council; as a member on the Hewlett Packard Financial Services Board of Advisors; as a member of the LOMA Board of Directors; and as Trustee of the Connecticut Women’s Hall of Fame.

| Key Qualifications:The Board believes that Ms. Zlatkus is qualified to |

Recommendation of the Board

The Board recommends that you vote “FOR” the election of these nominees.

| 8 PROPOSAL 1. ELECTION OF DIRECTORS |   | |

DIRECTORS CONTINUING IN OFFICE

The table below sets forth the names, ages, classes and positions of the directors who are not standing for election at the Annual General Meeting but whose term of office will continue after the meeting. Robert L. Friedman, a Class II director, will not be standing forre-election at the meeting, and will be retiring from the Board on May 7, 2020. Maurice A. Keane, a Class III director, will also retire from the Board effective May 7, 2020.

| Name | Age | Class | Position | Since | ||||

| Michael A. Butt(1) | 77 | I | Chairman of the Board | September 2002 | ||||

| Albert A. Benchimol | III | Chief Executive Officer and President | January 2012 | |||||

| | Independent Director | November 2001 | ||||||

| Anne Melissa Dowling | 61 | III | Independent Director | January 2020 | ||||

| Christopher V. Greetham | III | Independent Director | October 2006 | |||||

| | I | Independent Director | November 2018 | |||||

| Henry B. Smith(2) | 71 | III | Independent Director | May 2004 | ||||

| Barbara A. Yastine | Independent Director | |||||||

| (1) | Mr. Butt will retire from the Board effective September 16, 2020. |

| (2) | Effective upon Mr. Butt’s retirement from the Board, Mr. Smith will assume the Chairman role. |

Michael A. Butt | Experience: |

Former Chairman of Sedgwick Limited from 1982 to 1986 and also served as Vice Chairman of the Sedgwick Group plc.

Served as Chairman and Chief Executive Officer of Eagle Star Holdings plc and Eagle Star Insurance Company from 1987 to 1992.

Was Chief Executive Officer and President of Mid Ocean Limited from 1993 to 1998.

Served as director of XL Capital Ltd. from 1998 to 2002.

Former director of the Farmers Insurance Group; BAT Industries; and Instituto Nazionale delle Assicuranzioni.

From 2008 to 2009, served as Chairman of the Association of Bermuda Insurers and Reinsurers.

In 2019, was appointed as an Officer of the Order of the British Empire to commemorate his distinguished contributions toward the building of the Bermuda reinsurance industry.

Named by the International Insurance Society as its 2019 Insurance Hall of Fame Laureate.

Albert A. Benchimol |

Joined AXIS as Executive Vice President and Chief Financial Officer in January 2011.

Served as Executive Vice President and Chief Financial Officer of PartnerRe Ltd. from April 2000 through September 2010 and as Chief Executive Officer of PartnerRe Ltd.’s Capital Markets Group business unit from June 2007 through September 2010.

Prior to joining PartnerRe, Mr. Benchimol was Senior Vice President and Treasurer at Reliance Group Holdings, Inc. for 11 years and was previously with the Bank of Montreal from 1982 to 1989.

Assumed the role as Chair of the Association of Bermuda Insurers and Reinsurers in 2019, after serving as its Vice-Chair from 2017 through 2018.

Appointed as an External Member of the Council of Lloyd’s in February 2019.

| PROPOSAL 1. ELECTION OF DIRECTORS 9 | |

| Key Qualifications: |

| The Board believes that Mr. Benchimol is qualified to serve as a director based on his 38 years of experience in corporate finance, investments, the finance and insurance industry and his specific background as the Company’s Chief Executive Officer and President and, formerly, Chief Financial Officer. |

|

Currently, the Chief Executive Officer of Stone Point Capital LLC, serving since June 2005.

From 1998 until May 2005, was with MMC Capital, Inc., a subsidiary of Marsh & McLennan Companies, Inc., serving as the Chief Executive Officer from 1999 to 2005 and as Chairman from 2002 to 2005. Also served as a Vice Chairman of Marsh & McLennan Companies, Inc. from 1999 to November 2004.

Spent 23 years at Goldman, Sachs & Co., where, among holding other positions, he served as head of Investment Banking Services worldwide; head of the Financial Services Industry Group; a General Partner, a Senior Director; and as a Limited Partner.

Current director of The Hershey Company and The Progressive Corporation.

| Key Qualifications: The Board believes that Mr. Davis is qualified to serve as a director |

Anne Melissa Dowling | Experience: |

Served as Director of Insurance for the State of Illinois from 2015 to 2017 and as Deputy Commissioner of Insurance for the State of Connecticut from 2011 to 2015.

Held executive management roles in the areas of investments, treasury, strategic planning and marketing and governance at Massachusetts Mutual Financial Group; Connecticut Mutual Life Insurance Company; Travelers Insurance Company; and at Aetna Life & Casualty, where she began her career in 1982.

Current director of Prosperity Life Group and Insurance Capital Group and a current advisory board member for Carpe Data.

Former director of Spectranetics Corporation and former advisory board member for Life Epigenetics.

Received an M.B.A. from Columbia Business School and a B.A. from Amherst College and holds the Chartered Financial Analyst (CFA) designation.

| Key Qualifications: The Board believes that |

Christopher V. Greetham |

Served as Chief Investment Officer of XL Capital Ltd. from 1996 to 2006.

From 1982 to 1996, was Chief Financial Officer of OIL Insurance Ltd. and President of OIL Investment Corporation Ltd.

Served as an investment analyst and a portfolio manager at Bankers Trust Company between 1975 and 1982.

| Key Qualifications: The Board believes that Mr. Greetham |

|

|

|

| ||

| 10 PROPOSAL 1. ELECTION OF DIRECTORS |  | |

Elanor R. Hardwick |

|

Currently, the Chief Digital Officer of UBS, leading the bank’s innovation and digitization activities across all business lines and functions globally.

From 2016 to 2018, was former Head of Innovation of Deutsche Bank, leading innovation across business lines and functions globally and supporting the company’s digital strategy development.

Served as Chief Executive Officer of Credit Benchmark Ltd., a FinTechstart-up and provider of credit risk data, leading the company from its foundation in 2012.

Held a succession of senior leadership positions at Thomson Reuters, including Global Head of Strategy, Investment and Advisory; Global Head of Professional Publishing; and Head of Strategy for Europe and Asia.

Held positions at Morgan Stanley International; Booz-Allen & Hamilton; and the United Kingdom’s Department of Trade and Industry.

Earned an M.B.A. from Harvard Business School and an M.A. from the University of Cambridge.

| Key Qualifications:The Board believes that Ms. Hardwick is qualified to serve as a director |

|

Henry B. Smith |

Served as the Chief Executive Officer and President of W.P. Stewart & Co., Ltd. from May 2005 to March 2006.

Former Chief Executive Officer of the Bank of Bermuda Limited from March 1997 to March 2004.

Joined the Bank of Bermuda in 1973 serving in various senior positions including Executive Vice President and Chief Operations Officer; Executive Vice President Europe; and Senior Vice President and General Manager, Retail Banking.

| Key Qualifications: The Board believes that Mr. Smith |

Barbara A. Yastine | Experience: |

Former Chair and CEO of Ally Bank, a digital banking leader. Served as Chair from 2010 to 2015 and became interim CEO and President in 2011 before serving as CEO and President beginning in 2012. Also served as Chief Administrative Officer of Ally Financial from 2010 to 2012.

Is currently an active investor in private companies.

Current director of Primerica, Inc. and Zions Bancorporation.

Previously served on the Board of First Data Corporation from 2016 to July 2019 and also as a director andco-CEO of privately held Lebenthal Holdings, LLC from September 2015 to June 2016. In November 2017, Lebenthal and certain of its subsidiaries filed voluntary petitions for bankruptcy under Chapter 7 of the United States Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of New York.

Previously held various executive roles at Citigroup and Credit Suisse First Boston spanning over 17 years.

Received a B.A. in Journalism and an M.B.A. from New York University.

| Key Qualifications: The Board believes that Ms. Yastine is qualified to serve as a director based on her more than 30 years of management experience in the financial services and risk management sectors, including her prior role as Chair, Chief Executive Officer and President of |

|

| PROPOSAL 1. ELECTION OF DIRECTORS |  | ||

| CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE HIGHLIGHTS

Corporate governance is an area of significant focus for our Board and is a critical component to our success in driving sustained shareholder value. Highlights of our corporate governance standards are provided below:

| ✓ | Majority vote standard for election of directors. Each director must be elected by a majority of votes cast, not a plurality. |

| ✓ | No “over-boarding”. None of our directors serve on the board of directors of more than three other |

| ✓ |

| ✓ | Regular Board and |

| ✓ | Active Board refreshment process |

| ✓ | No hedging the economic risk of owning AXIS stock or pledging of AXIS stock for loans or other |

| ✓ | Independent |

| ✓ | Shareholders holding 10% or more of our outstanding stock have the right to call a special meeting. |

| ✓ | Majority independent Board. |

| ✓ | Independent Audit, Compensation and Corporate Governance and Nominating |

| ✓ | Robust Code of Business Conduct. AXIS is committed to operating |

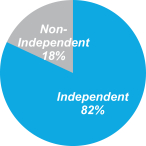

Our Board currently consists of 1013 directors, of whom eighteleven are independent directors.directors, and will be reduced in size to 11 directors effective May 7, 2020. As noted above, Messrs. Friedman and Keane will retire from the Board effective May 7, 2020. The Board has affirmatively determined that each of Messrs. Davis, Friedman, Greetham, Keane, Ramey, Smith and Zeller and Ms. Lister isMses. Dowling, Hardwick, Yastine and Zlatkus are independent as defined in the listing standards of the NYSE and in accordance with the Company’s Corporate Governance Guidelines. Mr. Benchimol serves as our Chief Executive Officer and President and therefore is not independent. Similarly, because Mr. Butt was an employee of the Company until his May 3, 2012 retirement and also is a consultant to us, he is not independent under the NYSE listing standards. Mr. Butt continues to serve as Chairman of the Board in his capacity as anon-management director. The Board has made these determinations based primarily on a review of the responses of the directors to questions regarding employment and compensation history, family relationships and affiliations and discussions with the directors.

With respect to Charles A. Davis, the Board reviewed his current relationship with Stone Point Capital LLC (“Stone Point”) and assets that we currently have under management with affiliates of Stone Point. The Board determined that neither of these relationships constitute a material relationship with us as defined in the listing standards of the NYSE. For more details about this relationship and transactions, see “Certain Relationships and Related Transactions” below.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our Chairman, Mr. Butt, received $500,000 in consulting fee payments in 2017 pursuant to the terms of a consulting agreement by and between Mr. Butt and the Company dated May 3, 2012, as amended. The consulting agreement was most recently amended on December 7, 2017 to extend the term of the agreement to the Company’s 2019 Annual General Meeting for an annual fee of $500,000.

Charles A. Davis is the Chief Executive Officer of Stone Point. In the ordinary course of business, we have contracted with SKY Harbor Capital Management, LLC, an affiliate of Stone Point, for asset management services for certain of our short duration high yield debt portfolios. In 2017, we paid $2,388,406 to SKY Harbor Capital Management, LLC. Additionally, we currently have $30 million committed to the NXT Capital Senior Loan Fund II and $30 million committed to the NXT Capital Senior Loan Fund III (the “NXT Funds”). The manager of the NXT Funds is an indirect subsidiary of NXT Capital Holdings, L.P. (“NXT Capital”). Stone Point, through an affiliated fund, owns approximately 42% of NXT Capital. During 2017, fees paid to NXT Capital totaled $859,509.

We also have $50 million committed to the Freedom Consumer Credit Fund, LLC Series B. The manager of this fund is Freedom Financial Asset Management, LLC (“Freedom”) which is an indirect subsidiary of Pantheon Partners, LLC (“Pantheon”). Stone Point owns a 14.5% interest in Pantheon through investment funds managed by Stone Point. During 2017, fees paid to Freedom totaled $1,140,380.

|

Policies and Procedures for Transactions with Related Persons.We analyzeWith the assistance of the Company’s Corporate Secretary and General Counsel, our Corporate Governance and Nominating Committee is required to consider and approve all transactions in which AXIS participates and in whichwhere a related person may have a direct or indirect material interest both due towhich involves an amount greater than $120,000. After considering the facts and circumstances, the Committee determines the potential for a conflict of interest and to determinealso whether disclosure of the transaction is required under applicable SEC rules and regulations. Related persons include any of our directors, director nominees or executive officers, certain of our shareholders and their respective immediate family members. A conflict of interest occurs when an individual’s private interest interferes, or appears to interfere, in any way with our interests. Our Code of Business Conduct requires all directors, officers and employees who may have either a potential or apparent conflict of interest to fullypromptly disclose all the relevant facts promptlysuch conflict to our General Counsel.

In addition to the reporting requirements under the

| 12 CORPORATE GOVERNANCE |  | |

We seek affirmative confirmation of compliance with our Code of Business Conduct to identify related person transactions,from our directors, officers and employees annually.

Additionally, each year, we submit and require our directors and executive officers to complete Director and Officer Questionnaires identifyingquestionnaires that require the identification of any arrangements or transactions with us in which the officer or directorthey or their family members have an interest. AnyAll potential related personrelated-person transactions are reviewed by our Corporate Governance and Nominating Committee, which pursuant to its charter is responsible for reviewing and approving any proposed transaction with any related person.

During 2019, our Chairman, Mr. Butt, received $350,000 in consulting fee payments pursuant to the terms of a consulting agreement by and between Mr. Butt and the Company dated May 3, 2012. The agreement was most recently amended on July 18, 2019 to extend the term of the agreement to December 31, 2020. Mr. Butt will not receive any additional fees for consulting services provided during the extended term.

Charles A. Davis is the Chief Executive Officer of Stone Point. In the ordinary course of business, we have contracted with SKY Harbor Capital Management, LLC, an affiliate of Stone Point, for asset management services for certain of our high-yield debt portfolios. In 2019, we paid $2.6 million to SKY Harbor Capital Management, LLC in management fees relating to these portfolios.

During 2019, we committed to invest $71 million in Stone Point’s Trident VIII. For the year ended December 31, 2019, we have not paid any fees to Stone Point in relation to Trident VIII.

We also have $52 million invested in the Freedom Consumer Credit Fund, LLC Series B, the manager of which is Freedom Financial Asset Management, LLC, an indirect subsidiary of Pantheon Partners, LLC. Investment funds managed by Stone Point own approximately 14.5% of Pantheon Partners, LLC. During 2019, fees paid to Freedom Financial Asset Management, LLC totaled $2.7 million.

In January 2020, we committed to invest $10 million in aco-investment with Stone Point to purchase a limited partnership interest inT-VIIICo-Invest-A LP, which is being formed by Stone Point to facilitate the investment by multiple investors in Duff & Phelps, a financial advisory firm. No management or other fees will be paid by AXIS to Stone Point in connection with Stone Point’s management of this investment.

Our Board maintains Audit, Compensation, Corporate Governance and Nominating, Finance, Risk and Executive Committees. Current copies of the charter for each of these committees, as well as our Corporate Governance Guidelines, are available on our website at www.axiscapital.com. The table below provides current membership and meeting information for each committee. In addition, the table identifies the independent directors, as determined by our Board within the meaning of the NYSE listing standards, applicable SEC regulations and our Corporate Governance Guidelines.

| Name | Audit | Compensation | Corporate Governance and Nominating | Finance | Risk | Executive | Independent Director | Audit | Compensation | Corporate Governance and Nominating | Finance | Risk | Executive | Independent Director | ||||||||||||||

| Albert A. Benchimol | Member | Member | Member | Member | ||||||||||||||||||||||||

| Michael A. Butt | Member | Member | ||||||||||||||||||||||||||

| Charles A. Davis | Chair | Member | Member | X | Chair | Member | Member | X | ||||||||||||||||||||

| Anne Melissa Dowling | Member | Member | Member | X | ||||||||||||||||||||||||

| Robert L. Friedman | Member | Member | X | Member | Member | X | ||||||||||||||||||||||

| Christopher V. Greetham | Member | Member | Member | Chair | X | Member | Member | Member | Chair | X | ||||||||||||||||||

| Elanor R. Hardwick | Member | Member | Member | X | ||||||||||||||||||||||||

| Maurice A. Keane | Member | Member | Member | X | Member | Member | Chair | X | ||||||||||||||||||||

| Cheryl-Ann Lister | Chair | Member | X | |||||||||||||||||||||||||

| Thomas C. Ramey | Chair | Member | Member | X | Chair | Member | Member | X | ||||||||||||||||||||

| Henry B. Smith | Member | Chair | Member | Chair | X | Chair | Member | Member | Chair | X | ||||||||||||||||||

| Barbara A. Yastine | Member | Member | Member | X | ||||||||||||||||||||||||

| Wilhelm Zeller | Member | Member | X | Member | Member | Member | X | |||||||||||||||||||||

| 2017 Meetings | 10 | 6 | 4 | 4 | 4 | 0 | ||||||||||||||||||||||

| Lizabeth H. Zlatkus | Member | Member | Member | X | ||||||||||||||||||||||||

| 2019 Meetings | 10 | 6 | 4 | 4 | 4 | 0 | ||||||||||||||||||||||

| CORPORATE GOVERNANCE 13 | |

Audit Committee. The Audit Committee has general responsibility for the oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, our independent auditor’s qualifications and independence and the performance of our internal audit functions and independent auditors. The Committee appoints, retains and determines the compensation for our independent auditors,pre-approves fees and services of the independent auditors and reviews the scope and results of their audit. The Audit Committee has been established in accordance with Rule10A-3 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each member of the Audit Committee is anon-management director and is independent as defined in the listing standards of the NYSE, our Corporate Governance Guidelines and under the Exchange Act. Our Board has determined that Mr. Ramey qualifies as an audit committee financial expert pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”).

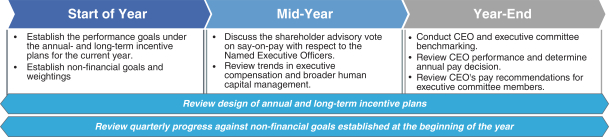

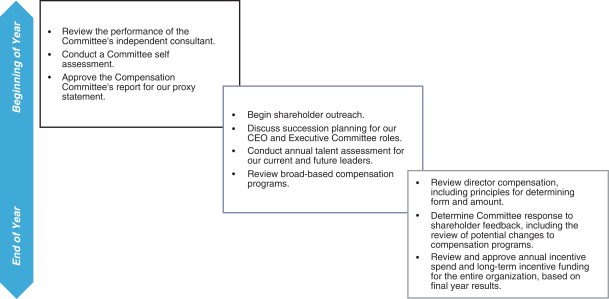

Compensation Committee. The Compensation Committee establishes compensation for our Chief Executive Officer and certain other executives in light of our established corporate performance goals and makes recommendations to our Board with respect to overall officer, management and employee compensation policies, incentive compensation plans, equity-based plans and director compensation. Each member of this Committee is a“non-employee director” for purposes of Rule16b-3 under the Exchange Act and is independent as defined in the listing standards of the NYSE. For a description of our processes and procedures for the consideration and determination of executive and director compensation, see “Compensation Discussion and Analysis” and “2017“2019 Directors Annual Compensation” later in this proxy statement.

|

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee takes a leadership role in shaping our corporate governance by identifying and proposing qualified director nominees,nominees; overseeing the purpose, structure and composition of our Board committees,committees; overseeing the annual evaluation of the Board and its committeescommittees; and periodically reviewing our Code of Business Conduct and Corporate Governance Guidelines. The Committee also oversees our corporate citizenship initiatives. Each member of this Committee is anon-management director and is independent as defined in the listing standards of the NYSE.

Finance Committee. The Finance Committee oversees the finance functioninvestment and treasury functions of the Company, including the investment of funds and financing facilities. It also is responsible for establishing our investment policies and guidelines, reviewing the selection of investment managers, evaluating the performance of investment managers, monitoring the need for additional financing and ensuring compliance with outstanding debt facility covenants.

Risk Committee. The Risk Committee assists the Board in its oversight of risks to which the Company is exposed and monitors our compliance with our aggregate risk standards and risk appetite. The Risk Committee also evaluatesreviews compensation practices to determine whether our policies and plans are consistent with the Company’s risk framework and do not encourage excessive risk taking.

Executive Committee. The Executive Committee may exercise the authority of the Board when the entire Board is not available to meet, except in cases where the action of the entire Board is required by our memorandum of association, ourbye-laws or applicable law.

MEETINGS OF THE BOARD AND ITS COMMITTEES

Pursuant to our Corporate Governance Guidelines, we expect our directors to attend all meetings of our Board, all meetings of all committees of the Board on which they serve and each annual general meeting, absent exigent circumstances. Our Board met nine (9)five (5) times during the year ended December 31, 2017.2019. No director attended fewer than 75% of the aggregate of the total number of meetings of the Board and the total number of meetings of all committees of the Board on which the director served (during the period that each director served on the Board or such committee(s)). All of our directors then in office attended our 20172019 Annual General Meeting.

MEETINGS OFNON-MANAGEMENT DIRECTORS

The Board believes that one of the key elements of effective, independent oversight is that the independent directors meet in executive session on a regular basis without the presence of management. In 2017, as part of the agenda for each of the four regularly-scheduled Board meetings,2019, the independent directors met in executive session with the Lead Independent Director presiding at sucheach of our four regularly scheduled Board meetings.

| 14 CORPORATE GOVERNANCE |  | |

The Board believes that the role of Lead Independent Director enhances effective governance. Mr. Smith currently serves as Lead Independent Director. In addition to presiding at executive sessions of thenon-management directors as well as all meetings at which the Chairman is not present, the Lead Independent Director’s duties include:

providing input on meeting scheduling, agendas and information that is provided to the Board;

acting as a liaison between the independent directors and the Chairman;

recommending, as appropriate, that the Board retain consultants who will report directly to the Board; and

consulting and communicating with major shareholders on a per requestper-request basis.

The Board believes that the decision of whether to combine or separate the positions of Chief Executive Officer and Chairman will vary company to company and depends upon a company’s particular circumstances at a given point in time. For our Company, the Board currently believescontinues to believe that separating the Chief Executive Officer and Chairman positions is the appropriate leadership structure and is in the best interests of our shareholders. In addition, the Board also believes that AXIS’ leadership structure does not affect the Board’s role in risk oversight of the Company. Accordingly, Mr. Butt currently serves as our Chairman of the Board, and Mr. Smith will assume the position of Chairman upon Mr. Butt’s retirement, while Mr. Benchimol serves as our

|

Chief Executive Officer and President. Our Board believes that this structure best encourages the free and open dialogue of alternative views and provides for strong checks and balances. Additionally, Mr. Butt’s attention to Board and committee matters allows Mr. Benchimol to focus more specifically on overseeing the Company’sday-to-day operations and underwriting activities as well as strategic opportunities and planning.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Messrs. Smith, Greetham, Keane and Ramey served on our Compensation Committee during fiscal year 2019 and effective January 1, 2020, Mses. Hardwick and Zlatkus and Mr. Zeller became members. During the year ended December 31, 2017,fiscal 2019, none of our executive officers served as a memberon the Compensation Committee (or its equivalent) or on the board of the compensation committee or as a directordirectors of another entity where one of whose executive officers served on our Compensation Committee or as one of our directors.members was an executive officer.

CONSIDERATION OF DIRECTOR NOMINEES

The Corporate Governance and Nominating Committee will consider candidates recommended by shareholders to be nominated to our Board for election at the Annual General Meeting. A shareholder who wishes to submit a candidate for consideration must be a shareholder of record at the time that such shareholder submits a candidate for nomination and must be entitled to vote for the candidate at the meeting. A shareholder must give written notice of the submission to our Secretary not less than 90 days nor more than 120 days prior to the anniversary of the annual general meeting for the preceding year; provided, that, if the date of the annual general meeting is moved more than 30 days before or after the anniversary date of the annual general meeting for the preceding year, the deadline for giving written notice of the submission to our Secretary will instead be a reasonable time before we begin to print and mail our proxy materials. The notice must include:

the name, age and business and residence addresses of the candidate;

the principal occupation or employment of the candidate;

the number of common shares or other securities of the Company beneficially owned by the candidate;

all other information relating to the candidate that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Exchange Act; and

the candidate’s written consent to be named in the proxy statement and to serve as a director if elected.

The notice also must include information on the shareholder submitting the nomination, including the shareholder’s name and address as it appears on our share register and the number of our common shares beneficially owned by the shareholder.

| CORPORATE GOVERNANCE 15 | |

COMMUNICATIONS WITH BOARD OF DIRECTORS

Shareholders and other interested parties may send communications to our Board by sending written notice to our Secretary at our headquarters at AXIS House, 92 Pitts Bay Road, Pembroke HM 08, Bermuda. The notice may specify whether the communication is directed to the entire Board, to thenon-management directors, to the Lead Independent Director or to a particular Board committee or other director. Our Secretary will handle routine inquiries and requests for information or will otherwise determine whether the communication is made for a valid purpose and is relevant to the Company and its business and, if he so determines, will forward the communication to our Chairman of the Board, to thenon-management directors or to the appropriate committee chairman or director. At each meeting of our Board, our Secretary presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to the directors on request.

EMPLOYEE, OFFICER AND DIRECTOR HEDGING

Our Insider Trading Policy prohibits our officers, employees and directors from transacting certain forms of hedging or monetization transactions (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our securities held by them.

RISK GOVERNANCE AND RISK MANAGEMENT ORGANIZATION

The key elements of our governance framework, as it relates specifically to risk management, are described below.

Board of Directors’ Level

The Risk Committee of the Board assists the Board of Directors in overseeing the integrity and effectiveness of our enterprise risk management framework and ensuring that our risk assumption and risk mitigation activities are consistent with that framework. The Risk Committee reviews, approves and monitors our overall risk strategy, risk appetite and key risk limits and receives regular reports from the Group Risk Management function (“Group Risk”) to ensure

|

any significant risk issues are being addressed by management. The Risk Committee further reviews, with management and Internal Audit,our internal audit function, our general policies and procedures and satisfies itself that effective systems of risk management and controls are established and maintained. Among its other responsibilities, the Risk Committee also reviews and approves our annual Own Risk and Solvency Assessment, or ORSA, report. The Risk Committee assesses the independence and objectivity of our Group Risk function, approves its terms of reference and reviews its ongoing activities.

Following a recommendation by ourthe Chief Executive Officer, the Risk Committee also conducts a review and provides a recommendation to the Board of Directors regarding the appointment and/or removal of the Chief Risk and Actuarial Officer. The Risk Committee meets with the Chief Risk and Actuarial Officer in separate executive sessionsessions on a regular basis.

The Finance Committee of our Board oversees our investment of funds and adequacy of financing facilities. This includes approval of aour strategic asset allocation plan.

The Audit Committee of our Board, which is supported by our internal audit function, is responsible for overseeing internal controls and compliance procedures andprocedures. The Finance Committee also reviews with management and the Chairman of the Risk Committee, of the Boardour guidelines and policies regarding risk assessment and risk management acrossmanagement.

As part of its oversight of risks and opportunities generally, our Board oversees the AXIS group.risks and opportunities relating to climate change.

Group Executive Level

Our management Executive Committee formulates our business objectives and risk strategy within the overall risk appetite set by our Board. It allocates capital resources and sets limits across the group,AXIS operating entities, with the objective of balancing return and risk. While the management Executive Committee is responsible overall for risk management, it has delegated some authority to the executive level Risk Management Committee.Committee, or RMC, consisting of the Chief Executive Officer, Chief Financial Officer, Chief Strategy Officer, Chief Underwriting Officer, each of the Chief Executive Officers for each segment, Chief Risk Officer, Chief Actuary and General Counsel.

The Risk Management CommitteeRMC is responsible for overseeing the integrity and effectiveness of ourthe Group’s enterprise risk management framework and ensuring that our risk assumption and risk mitigation activities are consistent with that framework,

| 16 CORPORATE GOVERNANCE |  | |

including a review of the annual business plan relative to our risk limits. In addition to the Risk Management Committee,RMC, there is an established framework of separate yet complementary management committees and subcommittees, which focusfocusing on particular aspects of enterprise risk management including the following:

Management Committees

The Business Council oversees underwriting strategy and performance, establishes return targets and manages risk/exposure constraints across each line of business, in line with the Company’s strategic goals.

The Product Boards for each major line of business aim to develop a coherent strategy for portfolio management, set underwriting guidelines and risk appetite and leverage expertise across the multiple geographies that we operate in. The Product Boards also oversee exposure management frameworks and view of risk.

The Investment and Finance Management Committee oversees our investment activities by, among other things, monitoring market risks, the performance of our investment managers and our asset-liability management, liquidity positions and investment policies and guidelines. The Investment and Finance Management Committee also prepares our strategic asset allocation and presents it to the Finance Committee of the Board for its approval.

The Capital Management Committee oversees the integrity and effectiveness of the Company’s Capital Management Policy, including the capital management policies of the Company’s legal entities and branches, and oversees the availability of capital within the AXIS operating entities.

The Group Reserve Committee ensures appropriate oversight and challenge of the Group and Segment Reserves, led by the Group Chief Reserving Actuary.

RMCSub-Committees

The Reinsurance Security Committee sets out the financial security requirements of our reinsurance counterparties and approves reinsuranceour counterparties, as needed.

The Operational Risk Committee oversees our operational riskthe Group’s Operational Risk framework for the identification, management, mitigation and measurement of operational risk and facilitates the embedding of effective operational risk management practices across ourthroughout the AXIS companies.

The Emerging Risks CommitteeWorking Group oversees the processes for identifying, assessing and monitoring current and potential emerging risks.

Group Risk Management Organization

As a general principle, management in each of our business units is responsible in the first instance for both the risks and returns of its decisions. Management is the “owner” of risk management processes and is responsible for managing our business within defined risk limits.

Our Chief Risk and Actuarial Officer, reportedwho reports to ourthe Chief ExecutiveFinancial Officer and the Chairman of the Board Risk Committee, leads our independent Group Risk function and is responsible for oversight and implementation of our enterprise

|

risk management framework as well as providing guidance and support for risk management practices. Group Risk is responsible for developing methods and processes for identifying, measuring, managing and reporting risk. This forms the basis for informing the Risk Committee of the Board and the Risk Management CommitteeRMC of our risk profile. Group Risk develops our risk management framework and oversees the adherence to this framework at the group and operating entity level. Our Chief Risk and Actuarial Officer regularly reportedreports risk matters to ourthe Chief ExecutiveFinancial Officer, management Executive Committee, Risk Management CommitteeRMC and to the Risk Committee of the Board.Committee.

Internal Audit,audit, an independent, objective function, reports to the Audit Committee of the Board on the effectiveness of our risk management framework. This includes assurance that key business risks have been adequately identified and managed appropriately and that our system of internal control is operating effectively. Internal Auditaudit also provides independent assurance around the validation of our internal capital model and coordinates risk-based audits, compliance reviews, and other specific initiatives to evaluate and address risk within targeted areas of our business.

| CORPORATE GOVERNANCE 17 | |

Our risk governance structure is further complemented by our Legal Departmentlegal department which seeks to mitigate legal and regulatory compliance risks with support from other departments. This includes ensuring that significant developments in law and regulation are observed and that we react appropriately to impending legislative and regulatory changes and applicable court rulings.

CODE OF BUSINESS CONDUCT AND CORPORATE GOVERNANCE GUIDELINES

Our Corporate Governance Guidelines, along with our Code of Business Conduct and the charters of each of the committees of our Board, of Directors, provide a framework for the corporate governance of the Company addressing matters such as director qualification standards, director responsibilities and duties and compensation of our directors. Our Corporate Governance Guidelines and our Code of Business Conduct apply to all of our directors, officers and employees, including our Chief Executive Officer and President, our Chief Financial Officer and our Controller and are available on our website at www.axiscapital.com. We intend to disclose on our website any required amendment to, or waiver of, a provision of the Code of Business Conduct that applies to our Chief Executive Officer and President, our Chief Financial Officer or our Controller. In addition, waivers of the Code of Business Conduct for our directors and executive officers may be made only by our Board or the Corporate Governance and Nominating Committee and will be promptly disclosed to shareholders on our website in accordance with the listing standards of the NYSE.

CORPORATE CITIZENSHIP AND SUSTAINABILITY

We define our corporate purpose as giving people and organizations the confidence to take necessary risks in the pursuit of their goals and ambitions. Our corporate citizenship program is organized around identifying, assessing and managing on an ongoing basis the environmental, social and governance factors that are relevant to our long-term financial performance. Our approach is to take into account the input of our core stakeholders, including our colleagues, our shareholders and our communities, and to consider material environmental, social and governance factors in our strategic planning and risk oversight.

The Corporate Governance and Nominating Committee of the Board has primary oversight responsibilities for our corporate citizenship program. The Committee regularly reports on citizenship and sustainability matters to, and receives the input of, the full Board. In addition, our senior management provides guidance for our citizenship and sustainability strategy and initiatives.

The Company has determined that it will focus its corporate citizenship efforts initially in four areas: environment (which includes environmental sustainability and climate-risk mitigation), diversity and inclusion, philanthropy and advocacy. Select initiatives in each of these areas are discussed below.

ENVIRONMENT

Since its inception, AXIS has been at the forefront of assessing and offering protection against weather-related risks such as hurricanes, storms, wildfires and floods, helping businesses and individuals proactively manage their exposure to such risks, and, when the need arises, recover from their aftermath. Our assessment of sustainability risks and opportunities takes into account the physical and transitional risks and opportunities of climate change. Through its NatCat Centre of Excellence, the AXIS Research Center, a newly formed climate-change working group, and local modeling teams, AXIS continues to advance research and monitoring of the newest science on climate change, as well as modeling and reviewing peril regions most likely to be affected thereby. For example:

AXIS is a member of the Bermuda Institute of Ocean Sciences’ Risk Prediction Initiative, which was formed in the wake of Hurricane Andrew in 1992. The Risk Prediction Initiative was formed in part to improve models for natural catastrophes and better estimate probable loss distributions.

AXIS partners with leading researchers and students at the University of Illinois’ Office of Risk Management and Insurance Research. This partnership is creating new natural catastrophe risk conceptualization models that leverage data analytics and computer programming. This partnership is part of AXIS’ longstanding commitment to promote education in areas relevant to the insurance industry and provide a platform to address areas like climate risk.

In 2019, we significantly scaled up our environmental and climate-risk work with additional initiatives such as the following:

AXIS formed the climate change working group, a cross-functional group tasked with (i) assessing climate-related risks and opportunities identified in other AXIS working groups focused on product development;

| 18 CORPORATE GOVERNANCE |   | |

(ii) evaluating and recommending changes to modeling, pricing and underwriting based on climate change; (iii) promoting knowledge-sharing across key groups on the topic of climate change; (iv) leading research into climate change and providing information to enterprise management and other senior decision makers; (v) collaborating with modeling vendors, market and regulatory groups to develop climate change scenarios that may have impacts on the Company (financial or otherwise); and (vi) considering emerging risks associated with climate change and liaising with the proper internal working groups and committees for their consideration in the areas of, among other things, product development and risk management. |

In October 2019, AXIS published its thermal coal and oil sands policy. AXIS was only the second insurer with significant U.S. operations to publish any such policy, and the first to publish one addressing oil sands. Reflecting AXIS’ belief that (re)insurers have an important role to play in mitigating climate risk and transitioning to alow-carbon economy, this policy limits the provision of (re)insurance to, or investment in, new thermal coal plants or oil sands infrastructure or the companies that build, own or operate such enterprises. The policy is a part of the Company’s broader strategy to reduce investments in lines that do not align with its long-term approach while investing in growth areas such as renewable energyinsurance-an area in which the Company has maintained its position as a top global (re)insurer, particularly of offshore wind and solar facilities.

AXIS has hosted, sponsored and/or had executives participate in a number of climate-risk-related panels. In November 2019, the Chairman of the Board, Mr. Butt, along with the Chairman of the Audit Committee, Mr. Ramey, and several senior executives participated in the “Future of Insurance Symposium: Climate Risk & Insurance Implications” hosted by the University of Illinois in partnership with their Office of Risk Management and Insurance Research and the AXIS Risk Management Academy. Together with researchers from the University, the panelists at November’s symposium discussed recent works on climate risks and how these risks affect business practices in the insurance industry now and prospectively. As part of this, AXIS and the Office of Risk Management and Insurance Research funded five faculty fellowships to continue to pursue relevant research.

In September 2019, AXIS hosted the International Society of Catastrophe Managers conference, “Climatechange-a key driver in catastrophe risk management, or one factor among many?” in Zurich, with over 80 participants and speakers. The aim of this conference was to provide different scientific, regulatory and (re)insurance/risk management industry views on the current and potential future impacts of climate change and to assess, among other things, whether assessments of cat risk will change in the future as our understanding of climate change and its causes and effects become better understood; what the quantification of climate change impacts will do to alter how the (re)insurance industry comprises its cat portfolios and charges premiums, and what concerns regulators are beginning to raise regarding climate risk.

We are also working on aligning our climate-related disclosures using Sustainability Accounting Standards Board principles.

As part of its oversight of risks and opportunities generally, our Board oversees the risks and opportunities relating to climate change.

At AXIS, investing in our people is a top priority. We strongly encourage our employees to develop critical capabilities that will aid in their professional and personal growth, propel their careers, and help them engage in the communities where they work and live. We also recognize the importance of a diverse workforce. Our goal is to elevate the level of service that we provide to our customers and partners, retain our top talent and support the communities where we do business. Some of our 2019 initiatives in furtherance of this goal are described below:

Last year, 20% of our open positions were filled by internal candidates. We aim to meet or exceed that goal in 2020, assisted in part by a new relationship that we established with a human capital analytics organization to foster a fair and equitable workplace by helping AXIS set, track and consistently improve diversity, equity and inclusion metrics.

We launched a management-development series, focusing on how our leaders can maximize the talent of their team members.

We also introduced our Early Careers Program in 2019, which includes a robust and growing summer internship program and an early career development program. The Early Careers Program is focused on building a diverse pipeline of talent for numerous careers at AXIS.

| CORPORATE GOVERNANCE 19 | |

AXIS Careers was created to provide our employees with a centralized repository of tools, resources, and training modules to assist them on their career journey at AXIS. This includeson-demand mobile courses, programming for early-career talent, leadership training, and more.

A key pillar of our corporate citizenship platform is diversity and inclusion. Encouraging a wide range of experiences, backgrounds and perspectives makes AXIS a more rewarding place to work, enables us to attract talented teammates, enriches our perspectives and makes us stronger as a global organization. Below are strategies and initiatives enacted to further the advancement of our diverse and inclusive culture:

AXIS continues to broaden its recruiting strategies to identify diverse candidates. Recent initiatives include:

| ¡ | Developing relationships with veterans’ organizations to utilize their job boards and candidate databases for open roles, and encourage the organizations’ members to participate in recruitment events; |

| ¡ | Establishing and enhancing existing relationships with diverse universities; and |

| ¡ | Providing recruitment training and manager coaching with a focus on enhancing managers’ effectiveness at recruiting diverse candidates. |